Road to business recovery during COVID-19

How to begin your road to recovery

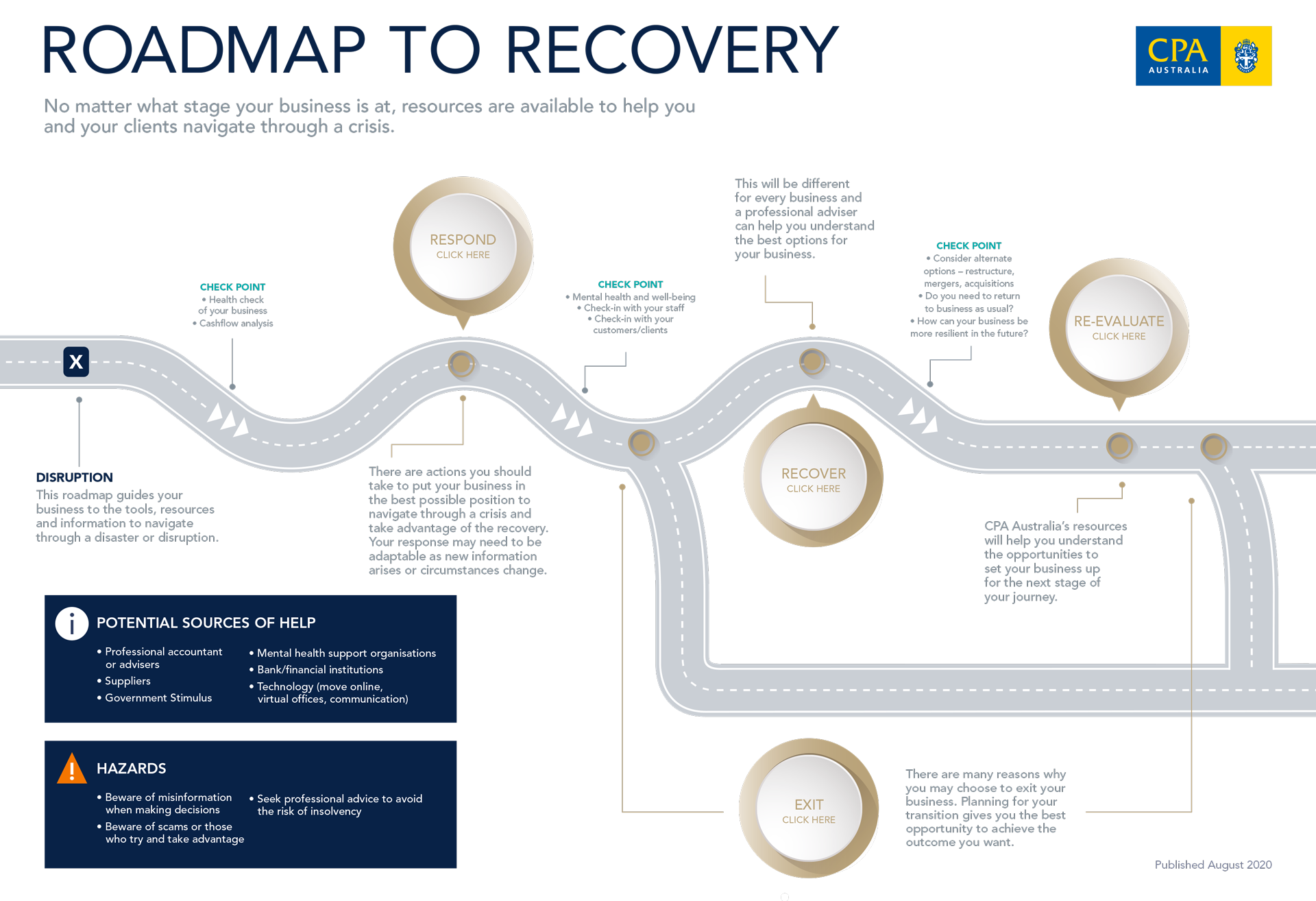

Times of crisis impact businesses in different ways. We've created a roadmap to help you or your clients navigate the way through recovery, no matter what stage your business is at. Simply click on the stage that's most relevant to your or your client's business.

No matter what stage your business is at, resources are available to help you and your clients navigate through a crisis.

Stage 1 – Respond

If your business has been impacted by COVID-19, there are a range of actions you can take to put you in the best possible position to navigate through the crisis and prepare to take advantage of the recovery.

It’s important to keep up-to-date with official information from trusted sources and government authorities, and adapt to changing circumstances that may impact your response.

Stage 2 – Recover

After taking immediate action to determine your business position and options, you can look to the recovery phase. This will be different for every business, so you’ll need to consider the option that’s best for you. A professional adviser can help you understand the options and future opportunities for your business.

It’s important to take the time to consider your own physical and mental health through the process, as well as the health of your business. Seek support if you need it, and explore our resources on how to build resilience and take care of your mental health. The resources below contain key information about business recovery.

As governments begin easing restrictions in stages, businesses will recover at different paces based on their location and industry. Our tips, checklists and templates will help start your business recovery.

In this publication, joint professional bodies explore the difficulties that directors, preparers of financial statements, accountants and auditors face when disclosing the impact of COVID-19 in their annual reports.

As organisations continue to respond, recover and re-create themselves, our members are finding they are taking on a variety of tasks including strategic planning, risk management, scenario modelling and financial reporting functions. This briefing from the CPA Australia ESG Centre of Excellence explores some of the key risks from COVID-19 that accountants, risk managers and other board executives or advisers should consider irrespective of size, nature and complexity of business.

This SWOT analysis template will help you identify your business’s strengths, weaknesses, opportunities and threats so you can make smarter decisions moving forward and better understand your business. By addressing these characteristics, it gives you an opportunity to take stock of your business and figure out where you can improve.

Stage 3 – Re-evaluate or reinvent

Sometimes a crisis will be an opportunity to re-evaluate and reset your business goals and objectives. You may decide to completely change your operations or find new opportunities. Similarly, you may decide that it's time for you to change paths and leave the business.

Our resources will help you determine your future strategy, build on opportunities and set yourself up for your next stage of the journey. Refer to the below resources for insights to help re-evaluate or re-invent your business for the future.

This fact sheet is aimed at small e-commerce businesses. It provides advice and tips on how to on to stand out from your competitors and how to build trust with your customers.

MY FIRM. MY FUTURE eLearning series

A set of practical and complimentary e-learning modules to help you prepare for the challenges and take advantage of the opportunities to build a sustainable business. These modules complement findings from the MY FIRM. MY FUTURE report and will help you ready your practice for the future.

- Business management

MY FIRM. MY FUTURE webinar series

In addition to changes in technology, legislation and shifting client demands, COVID-19 has drastically altered the accounting landscape. The MY FIRM. MY FUTURE webinar series has been developed to help CPA Australia members in practice adapt and plan for both the short term and the long term, and build a sustainable practice.

- Public practice

- Training and events

By the book: Disruption, innovation and COVID-19

article·Published onVisit INTHEBLACK

Exit your business

There are many reasons behind the decision to exit a business and planning this transition gives you the best opportunity to achieve the outcome you want. We strongly recommend you seek professional advice throughout the process to give you the best chance of successfully exiting your business.

Once you’ve made the decision to close a business, it’s not simply a matter of shutting the doors and handing the keys back to the landlord. Whether you’re selling your business, merging with another business, passing it on to family members or key staff, or liquidating the business, this checklist sets out the actions business owners should consider taking.

There are many reasons why a business owner may want to exit their business. Regardless of your reasons, planning your exit to maximise your business’ value will probably be the most important decision made during your business’s lifecycle. This guide will help you through the process, including ways to exit your business, selling your business, merger, succession, closing your business, solvency and any other issues you need to consider.

This factsheet provides an overview of the options available for your clients in financial distress, in order to help you navigate them through this health and economic crisis.

We’ve produced this factsheet for public practitioners because the risk of corporate failure under the current and evolving COVID-19-related economic circumstances is unprecedented. This guide provides clarification on insolvency matters, including insolvency as opposed to a temporary lack of liquidity; the nature of due and payable; relationships between debtor and creditor, and the course of commercial dealing; and indicators of insolvency.

If you're struggling to keep up with compliance obligations or experiencing concerning changes in customer behaviour, it could be an early warning sign that your business may be in trouble. This factsheet can help you identify the warning signs, take early action and get back on track.

Discover more

COVID-19 support

Resources, guides and information to support you and your clients

- COVID 19

Influencing public policy during COVID-19

CPA Australia's submissions to government and analysis of COVID-19 stimulus and support packages

- COVID 19

Reporting and auditing during COVID-19

Requirements and implications of COVID-19 on financial reporting and auditing

- COVID 19

Information resources

Links to official information on restrictions and business requirements in Australia

- COVID 19

Grants and business support

Financial support was available for eligible businesses affected by lockdowns and public health orders

- COVID 19

Member updates

See how COVID-19 may impact your business

- COVID 19